Updated January 2, 2014: This column has been revised to include two new paragraphs that clarify the differences between the methodology used for this analysis and the methodologies employed by the academic papers cited and other similar academic analyses.

Raising the minimum wage would be good for our economy. A higher minimum wage not only increases workers’ incomes—which is sorely needed to boost demand and get the economy going—but it also reduces turnover, cuts the costs that low-road employers impose on taxpayers, and pushes businesses toward a high-road, high-human-capital model.

Despite these positive benefits, and the sad fact that the minimum wage is worth far less today than it was in the late 1960s, with the Senate set to vote to raise the federal minimum wage from $7.25 to $10.10 per hour, opponents will likely trot out the same unfounded argument that the minimum wage reduces employment. And with today’s unemployment rate stuck above 7 percent, we anticipate these types of arguments to reach a fevered pitch.

The evidence, however, is clear: Raising the minimum wage does not have the harmful effects that critics claim.

A significant body of academic research finds that raising the minimum wage does not result in job losses, even during periods when the unemployment rate is high. Critics of the minimum wage, however, often hold on to the claim that raising the minimum wage will lead to job losses and ultimately hurt the overall economy, exacerbating the problem of high unemployment. The argument that raising the minimum wage will increase unemployment is somewhat far-fetched, since the minimum wage impacts a relatively small share of the overall workforce, which is itself concentrated in certain industries such as restaurants and demographic groups such as teenagers.

Nevertheless, we analyzed more than two decades’ worth of minimum-wage increases in U.S. states and found no clear evidence that the minimum wage impacts aggregate job creation during periods of high unemployment.

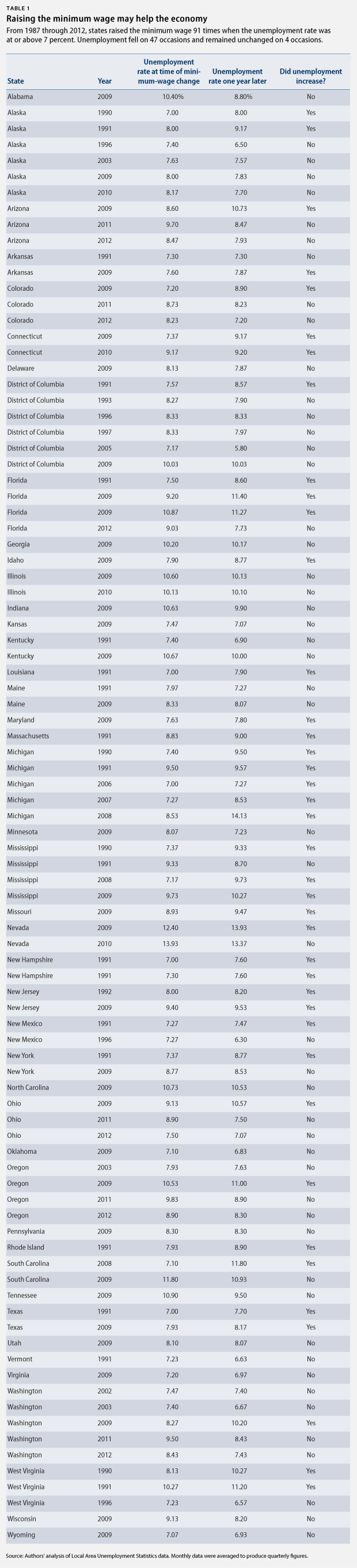

Our analysis includes every state that saw its effective minimum wage increase from 1987 through 2012, when the state’s unemployment rate was at or above the current rate of 7 percent. We then studied changes in employment in these states over the next year.* We include minimum-wage increases that occur because of either state or federal action, though we disaggregate results later.

According to our analysis, the majority of states that raised the minimum wage saw a decrease in their unemployment rate over the next year. There were a total of 91 cases where a state minimum-wage increase occurred during a period of high unemployment over the past two and a half decades. In 47 of these cases, the unemployment rate decreased over the next 12 months, and in 4 other cases the unemployment rate remained unchanged. In contrast, there were only 40 occurrences where the unemployment rate increased. That means when a minimum-wage increase occurred during a period of high unemployment, unemployment rates actually declined 52 percent of the time. (see Table 1)

Comparisons to national averages produce similar results. Of the 91 cases of minimum-wage increases during high unemployment, states saw their unemployment rate fare better than the national unemployment rate 51 times over the subsequent 12 months. A few states, including Alabama and Tennessee in 2009, saw their unemployment decrease much more than the national average. Following the minimum-wage increase that year, Alabama and Tennessee’s unemployment rates fell by 1.6 percentage points and 1.4 percentage points, respectively, compared to a decline in the national unemployment rate of only 0.1 percentage points. To be fair, some states, such as Michigan in 2008, had significantly worse outcomes than the national average. However, a majority of states that raised their minimum wage did slightly better than the national average. Comparing state employment growth to the national average produced similar results.

Furthermore, a separate analysis of minimum-wage increases that occurred as a result of federal action versus increases coming from state action yields nearly identical results. No matter what caused the increase, more than half of the states that increased their minimum wage saw their unemployment rates decline or remain unchanged. Ultimately, from a look at the aggregate data, there is not clear correlation that minimum-wage increases are associated with harmful changes in unemployment or job growth.

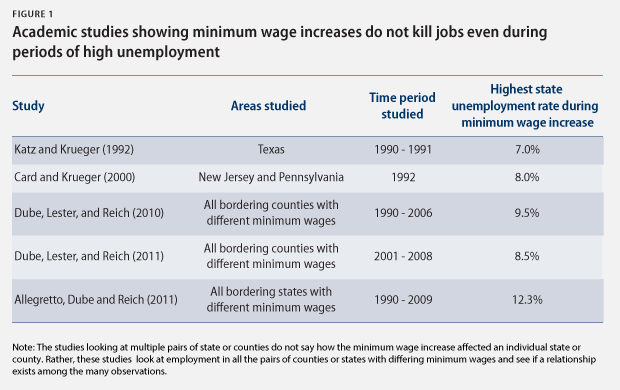

This basic state-by-state comparison of what happens to unemployment and/or aggregate employment one year after a minimum-wage increase—rather than providing conclusive evidence on its own—suggests instead that one must dig deeper to look for the real causal effects of the minimum wage. As the data above suggest, there are wide regional variations in economic trends across states, for example, Michigan versus Alabama. These regional growth differentials are unrelated to minimum-wage policy and are driven rather by deeper structural forces including decades-long industrial restructuring processes and divergent population trends, to name a few—all of which may obscure the impact of minimum-wage changes. Fortunately, there are at least five different academic papers that utilize a research design that controls for precisely such regional trends. Specifically, these papers collectively find that an increase in the minimum wage has no significant effect on employment levels. Critically, these papers all include in their samples periods of high unemployment, with unemployment rates ranging from 7 percent to 12.3 percent. These five academic studies also cover different geographical areas and different time periods, and use a range of methodologies—from small case studies to large econometric analysis—lending great credibility to their findings. In addition, they focus on highly impacted groups such as restaurant workers and/or teenagers, where minimum-wage increases actually result in wage increases (i.e., they are binding). (see Figure 1)

Furthermore, the most recent studies are considered significant improvements over previous studies because of the methodologies employed. Specifically, these studies accurately control for confounding regional trends by either controlling for heterogeneous trends across Census divisions, or by examining all U.S. counties along state borders that had different minimum wages. This research design combines the detailed analysis possible in case studies with the generalizability of a nationally representative sample. All of the studies came to the same conclusion: Raising the minimum wage had no effect on employment levels.

Contrary to most of the rhetoric, the results of these studies are not surprising because research indicates that raising the minimum wage boosts demand, increases worker effort, and reduces turnover, counteracting the higher wage costs.

What’s more, there may be another factor that comes into play even more during hard times: economic power. Low-wage workers have very little of it, particularly during periods of high unemployment.

When the economy is doing poorly, employers have less incentive to raise wages, while workers, especially those making near minimum wage, have little ability to demand a raise because there is a ready supply of unemployed labor available to take their job. Even though these workers likely become more productive—labor productivity has generally increased over time, and productivity growth during the past two recessions was especially strong—they have less economic power to share the gains of their increased productivity. This suggests that during hard economic times, there is a critical role for government to raise the minimum wage to ensure that workers are being paid for their economic contributions.

In short, policymakers should feel confident that raising the minimum wage would not hurt employment. Instead, it would provide the kind of boost in consumer demand that our economy sorely needs.

T. William Lester is an assistant professor in the department of city and regional planning at the University of North Carolina, Chapel Hill. David Madland is Director of the American Worker Project at the Center for American Progress Action Fund. Jackie Odum is a Special Assistant at the Action Fund.

* Note: Analysis presented in this column is based on changes from the quarter that the minimum wage occurred to the similar quarter the following year. Analysis based on the quarter after the minimum wage occurred produces similar results.

Full citations for academic papers in Figure 1:

Arindrajit Dube, T. William Lester, and Michael Reich, “Minimum Wage Effects Across State Borders: Estimates Using Contiguous Counties,” The Review of Economics and Statistics 92 (4) (2010): 945–964.

Arindrajit Dube, T. William Lester, and Michael Reich, “Do Frictions in the Labor Market? Accessions, Separations and Minimum Wage Effects.” Working Paper 5811 (IZA Discussion Paper Series, 2011).

David Card and Alan B. Krueger, “Minimum Wages and Employment: A Case Study of the Fast-Food Industry in New Jersey and Pennsylvania: Reply,” American Economic Review 90 (5) (2000): 1397–1420.

Lawrence F. Katz and Alan B. Krueger, “The Effect of the Minimum Wage on the Fast-Food Industry,” Industrial and Labor Relations Review 46 (1) (1992): 6–21.

Sylvia A. Allegretto, Arindrajit Dube, and Michael Reich, “Do Minimum Wages Really Reduce Teen Employment? Accounting for Heterogeneity and Selectivity in State Panel Data,” Industrial Relations 50 (2) (2011): 205–240.